MARKETS,Anybody even yet?

-

FAA

- Video Poker Master

- Posts: 9487

- Joined: Wed May 28, 2014 11:58 am

Re: MARKETS,Anybody even yet?

A core belief that this sector will be the future driver of economies. FOMO syndrome, maybe.

-

dinghy

- Video Poker Master

- Posts: 2009

- Joined: Mon Apr 29, 2019 8:24 am

Okay thanks. My (admittedly contrarian) argument is, I don't want to buy "good" companies; I want cheap companies. Any stock purchase can be good at a low price, or bad at a high price.

You mentioned Apple. Fred Hickey wrote this in early April, a little before the Liberation Day crash:

"Even with today’s sharp decline, Apple’s P/E ratio is still

over 32 times its relatively stagnant earnings. For comparison

purposes, sales of Apple’s iPhone began on June 29, 2007 and

it totally transformed the company. During the 2010-2019

decade, Apple’s revenue growth rate was 17.9%, yet its

average P/E ratio during that period was 16.2. Cut Apple’s

stock in half from here, (Apple would be trading around $100)

and the stock would be valued as if it was still a relatively high

growth company – which it is not (revenue growth is closer to

zero)."

Many such cases.

Anecdotally, almost any time I chat up a random about stock investing, they mention tech stocks. It's the one sector that's widely accepted as must-own.

-

dinghy

- Video Poker Master

- Posts: 2009

- Joined: Mon Apr 29, 2019 8:24 am

-

olds442jetaway

- Video Poker Master

- Posts: 11475

- Joined: Tue Aug 21, 2007 9:08 pm

I made a typo above. Didn’t check my math like I usually do. Only up 2 percent for the year not 6.5  . O well. Up is up.

. O well. Up is up.

-

dinghy

- Video Poker Master

- Posts: 2009

- Joined: Mon Apr 29, 2019 8:24 am

I'm having a good year. New all-time high today.

But I'm somewhat backed into a corner, with only one sandbox to play in. I own a lot of nat king resources, and not much of anything else.

I have no prospects either. I added a few food stocks, but I'm not confident enough to munch a bunch.

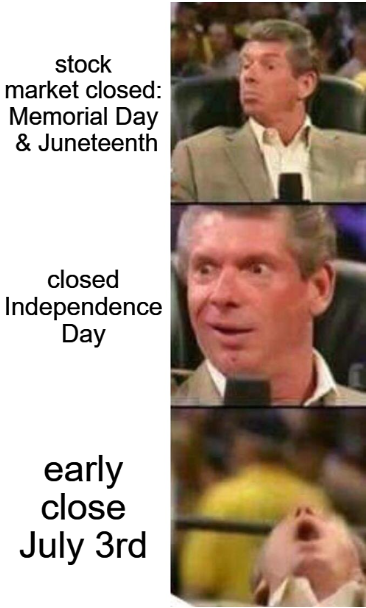

Things can change though. I'll be up early for the 5:30 am (Pacific time) monthly employment report, followed by about 3.50 hours of trading before the long pause.

-

olds442jetaway

- Video Poker Master

- Posts: 11475

- Joined: Tue Aug 21, 2007 9:08 pm

Ditto up early. Maybe that’s why Berkshire is sinking. Still a huge like 25 percent position in AAPL

-

FAA

- Video Poker Master

- Posts: 9487

- Joined: Wed May 28, 2014 11:58 am

Great minds think alike, Olds! At least I hope this is the case. He also donated $6B worth of stock. It’s someone else’s problem now!

-

FAA

- Video Poker Master

- Posts: 9487

- Joined: Wed May 28, 2014 11:58 am

Dinghy, Microsoft and Visa have similarly lofty P/Es. It’s troubling, as I own both. Projected prices are high too, but those pie in the sky numbers don’t always hit.

-

olds442jetaway

- Video Poker Master

- Posts: 11475

- Joined: Tue Aug 21, 2007 9:08 pm

Trying a little bottom feeding before the early close. Gotta get back to find something. Report back if any “ gems “ found.

-

dinghy

- Video Poker Master

- Posts: 2009

- Joined: Mon Apr 29, 2019 8:24 am

Looks like I'll go out with only one stock purchase the entire (such as it is) week. That was a small reload of WDOFF Wesdome Gold Mines at 13.32. I like Wesdome because all the news has been good, including strong drill results a few days ago -- while the price has declined. This is probably the most obscure of my top holdings. It doesn't even have a regular ADR listing in the States, only the OTC ticker.

Of the two, I only hate Microsoft. (Haven't looked at Visa