dinghy wrote: ↑Sat Jul 19, 2025 5:07 pm

I need to listen again to Michael Green

I did, and he gave me a few impressions.

Retirement money is being herded into the US stock market. Due to lobbying efforts, employees are now routinely defaulted into their 401K or similar plans. They're automatically enrolled, and the money automatically goes to stocks -- often via a Vanguard target date fund, which is 90% stocks for younger employees.

Retirement money is estimated at 35% of the US stock market. The majority of retirement money is held by Boomers (born 1946 to 1964).

As long as the money keeps flowing, US stocks are supported. Risks include withdrawals by Boomers as they begin spending the money in retirement. Or, retirement savers could reevaluate their allocation to stocks. Boomer retirement assets are estimated at nearly 50% stocks, which afaik is high by historical standards. Should the US stock market undergo a period of poor performance, working-age savers may reduce their stock % (which was chosen for them).

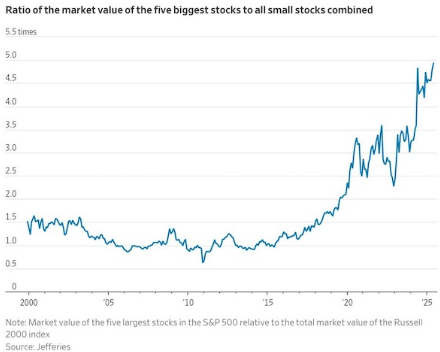

Retirement money in stocks is mostly invested passively with market-cap weighting, which means top-performing stocks receive boosted flows. Green refers to this as positive momentum loading.

This overall setup looks like a recipe for distorted reality. Top stocks are priced far above intrinsic value, while laggards lag further. It continues until it doesn't, but an ugly disconnect is possible when TSHTF.

It's possible to argue that bonds are cheap now because the money flows to stocks, and recent poor performance has repelled investors from the sector.

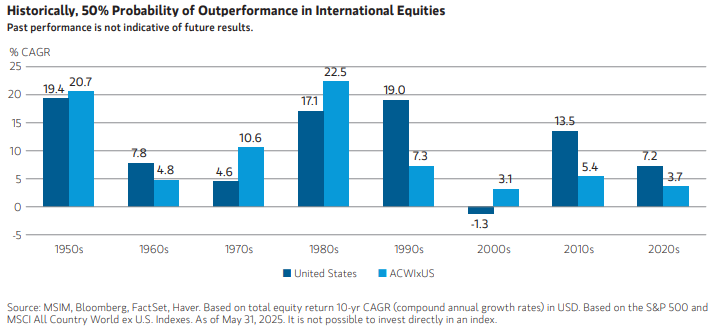

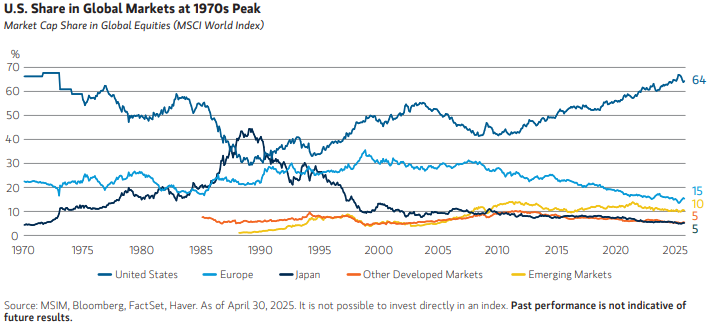

Passive dominance is mostly a US phenomenon. A report from PWL Capital of Canada indicates 53% passive in the US, vs 30% passive outside of North America.